The International Monetary Fund (IMF) has urged the Bank of Ghana (BoG) to reduce its interventions in the foreign exchange market to allow for greater exchange rate flexibility.

In its post-review statement, IMF’s Deputy Managing Director Bo Li said “The authorities have made significant strides toward rebuilding international reserves and taken steps to bring inflation down. The Bank of Ghana should maintain an appropriately tight monetary stance until inflation returns to its target, reduce its footprint in the foreign exchange market, and allow for greater exchange rate flexibility, including by adopting a formal internal FX intervention policy framework.”

Adding that “The authorities are strongly committed to restoring fiscal discipline and addressing the structural weaknesses that led to the slippages. They have passed a 2025 budget consistent with the program’s objectives and enacted an enhanced fiscal responsibility framework. Looking ahead, staying the course of fiscal adjustment and completing the debt restructuring are key to ensure fiscal sustainability. This should be supported by continued efforts to enhance domestic revenue mobilization and streamline non-priority expenditure, while creating space for development priorities and enhanced social safety nets. Improving tax administration, strengthening expenditure controls, and improving SOEs’ efficiency are of the essence to underpin durable adjustment. In this context, forcefully addressing the challenges in the energy sector and addressing related arrears are critical to contain fiscal risks.”

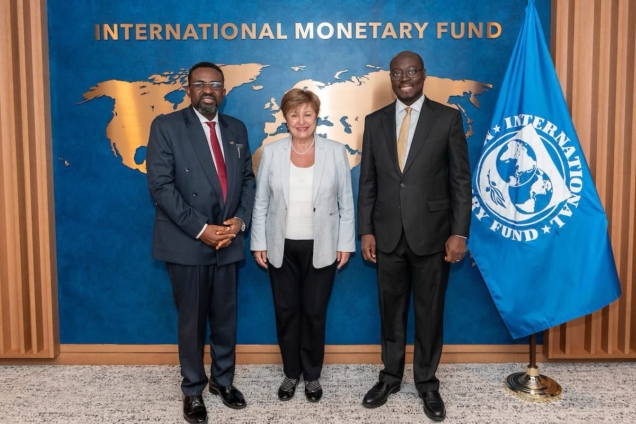

His statement comes after the Executive Board of the International Monetary Fund (IMF) today completed the fourth review of the US$3 billion, 36-month Extended Credit Facility (ECF) Arrangement, which was approved by the Board in May 2023. Completion of the fourth ECF review allows for an immediate disbursement of about US$367 million (SDR 267.5 million), bringing Ghana’s total disbursements under the arrangement to about US$2.3 billion.

Bo Li indicated that Ghana “Faced with large policy slippages and reform delays at end-2024, the new administration has taken bold corrective actions to maintain the program on track. Combined with ongoing reform efforts and an improved external position, the corrective measures are set to support Ghana in reaching the goals of economic stabilization, rebuilding resilience, and fostering higher and more inclusive growth.

“The authorities have taken intensified actions to address undercapitalized banks. Looking ahead, further strengthening financial sector stability requires fully implementing the plan to strengthen NIB, finalizing the reform strategy to support state-owned banks’ viability and sustainability, and developing contingency plans to address weak banks that fail to recapitalize. Stepped-up efforts to improve the crisis management and resolution framework, enhance financial-sector safety nets, and address legacy issues at the specialized deposit-taking institutions are also important.”

Source: Elvisanokyenews.net

ElvisAnokyenews Latest News Portal

ElvisAnokyenews Latest News Portal